Any business has its core area of activity: whether manufacturing, producing, selling, or others. A common trait of all businesses is the need to maintain records of their sales and purchase figures, accounts, cash flows, profit & loss, etc. Finally, businesses follow tax laws to contribute to the growth of the nation.

Any business has its core area of activity: whether manufacturing, producing, selling, or others. A common trait of all businesses is the need to maintain records of their sales and purchase figures, accounts, cash flows, profit & loss, etc. Finally, businesses follow tax laws to contribute to the growth of the nation.

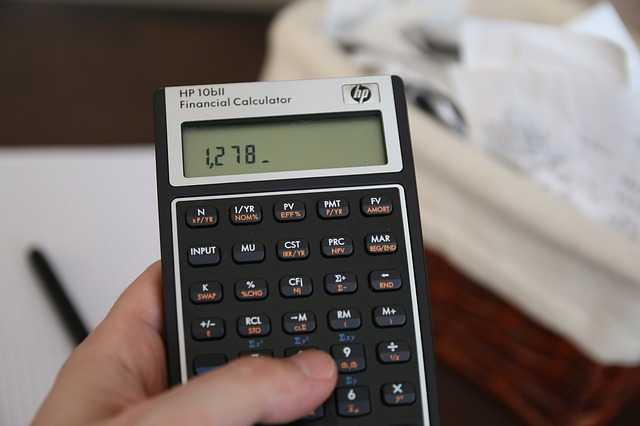

Since these laws can be complex, and some may depend on the nature of the enterprise, advisors recommend hiring an accountant. Professionals in this field such as Scolari Comerford are well-versed in the areas of financing, accounting procedures, taxation, insurance, and other financial matters. Save time by entrusting them with this responsibility. Consequently, you will have more time and energy to focus on your core business.

The following are some facts you should know as a business owner:

• Maintain regular records of receivables, payables, liabilities, etc. and work out the annual taxable income.

• Determine your allowed deductions to reduce your taxable income. While you can claim common deductions, you need to figure out the others such as specific expenses. There are some limits, though, on the amount you can claim on these.

• Accountants will help you understand the tax credits and offsets you are eligible for, such as credits for persons with disability or childcare, upkeeps for research facilities, and fuel tax credit.

• It also applies for investments in vehicles that run on alternative energy sources, saving the environment campaigns, and rehabilitation projects.

• After determining all the above figures accurately, you have to file an annual tax return.

• Paying taxes are as easy as registering online and paying through this portal. The Australian Taxation Office will allot a specific number for your account. Among many things, you can view your credits and deductions on their website.

The often-convoluted world of taxation is by no means a walk in the park. To help you navigate this complex maze, hire a professional accounting service so they can do the work for you, and you can concentrate on the growth of your business.

Be the first to comment on "Tax Facts for Small Business Owners"